🌏 Deep Dive into the World of CMBs (Community managers & builders)

In 2022 after the pandemic, “community” became such a trend word every online business and startup decided to take their own shot at the game. Today, the world of community building has led an avalanche of new and old community managers, builders, and organisers to scramble on their feet doing everything and anything from customer service, sales, onboarding, and social media to operations - yet most still struggle to define their actual “role” in the company.

Recently, Australian Community Managers) and The Community Collective collaborated to bring about a Community Manager Snapshot of the Startup Space (2023), brimming with insights from the platforms used widely by community managers, to salaries and key tasks, to challenges in their working environment. This has stirred up possibilities for improvement in the community-building space, for both the better well-being and stress management of community builders, and to spearhead the emergence of more diverse communities in the digital age.

At NARU, we have witnessed the power of communities to bring people together and empower social impact. Our global mission is to create a safe space for every human to grow through social accountability so that a million leaders can build sustainable communities to change the world. To recognise this, we spoke to a handful of community managers about their experience of reconnecting with humans post-COVID-19 pandemic. Through our research, we aim to clarify the conversations around community building to understand the landscape of startup communities in Australia.

Top insights:

Full-time employees and founders form the majority of community managers and builders in the Australian startup ecosystem.

Startups that hire community managers/builders are usually less than 10 employees in size, adding responsibility for CMBs to wear multiple hats.

To invest in a community, startups prefer to be revenue-generating and profitable.

There are many reasons for startups to build communities - these differ from type and size of organisations, to expertise and industry.

Social impact is becoming more important for startups building communities, with most at least being socially aware of the impact they can cause through their members.

A higher percentage of females in community manager/builder roles may be causing more communities to focus on removing racial and social injustices together with improving literacy and educational inequality.

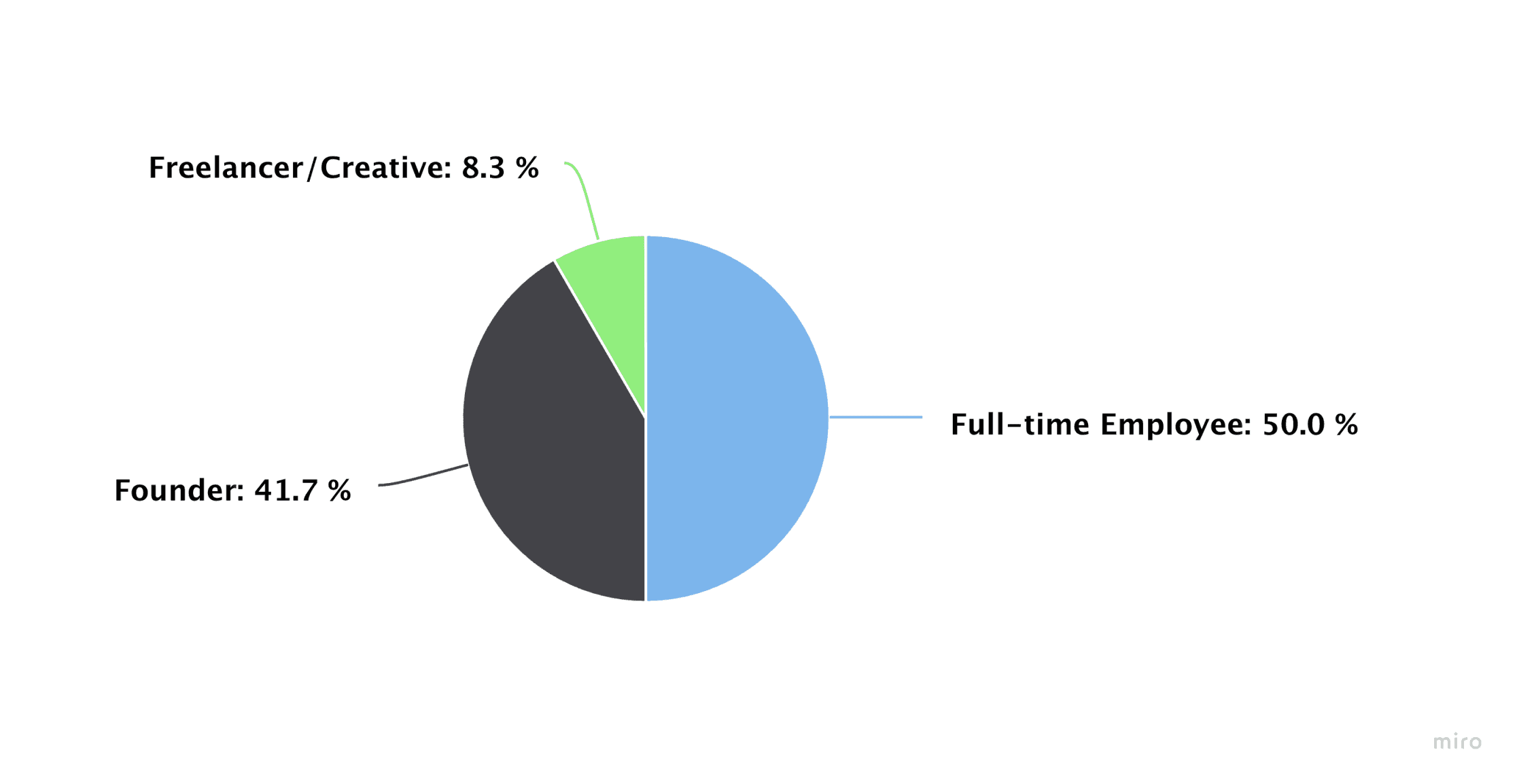

Role in the marketplace

When asked about their role in the marketplace, most community builders in the 2022-2024 Australian startup ecosystem work either as full-time employees for a company investing in community-building (as a way to improve their customer service, product collaboration, etc. more about this in “Community purpose”) or are the founders of their own company.

Roles in marketplace breakdown:

Full-time employee - 50%

Founder - 41.7%

Freelancer/Creative - 8.3%

NARU's CMB Research: Role in the marketplace (2022-2024).

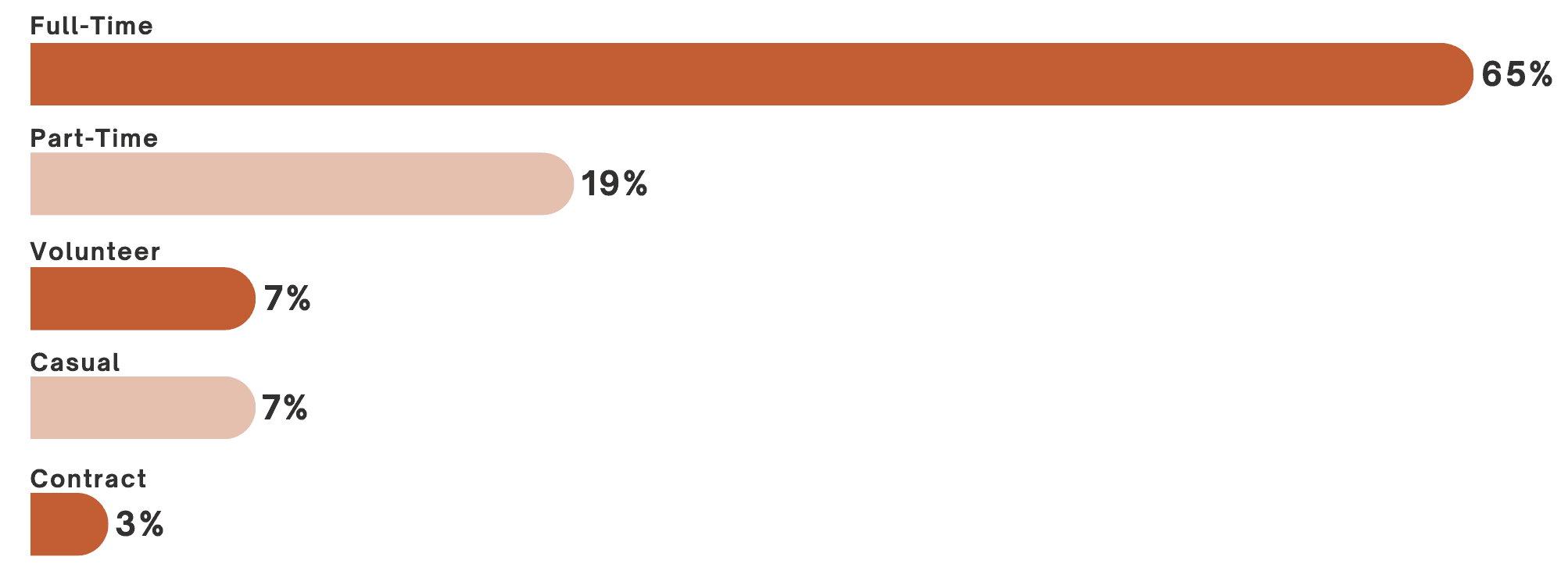

This isn’t surprising as the ACM x The CC Community Manager Snapshot found that technology and Business / Entrepreneurial are the leading sectors hosting communities in the startup space across Australia and New Zealand (surveyed around 101 community builders). Out of these, 65% of community builders in the startup space work in a full-time role. However, at the same time, it is notable that some freelancers and creatives may look to communities to raise awareness about their brands and services.

ACM x The CC Community Manager Snapshot: Working Status (2023).

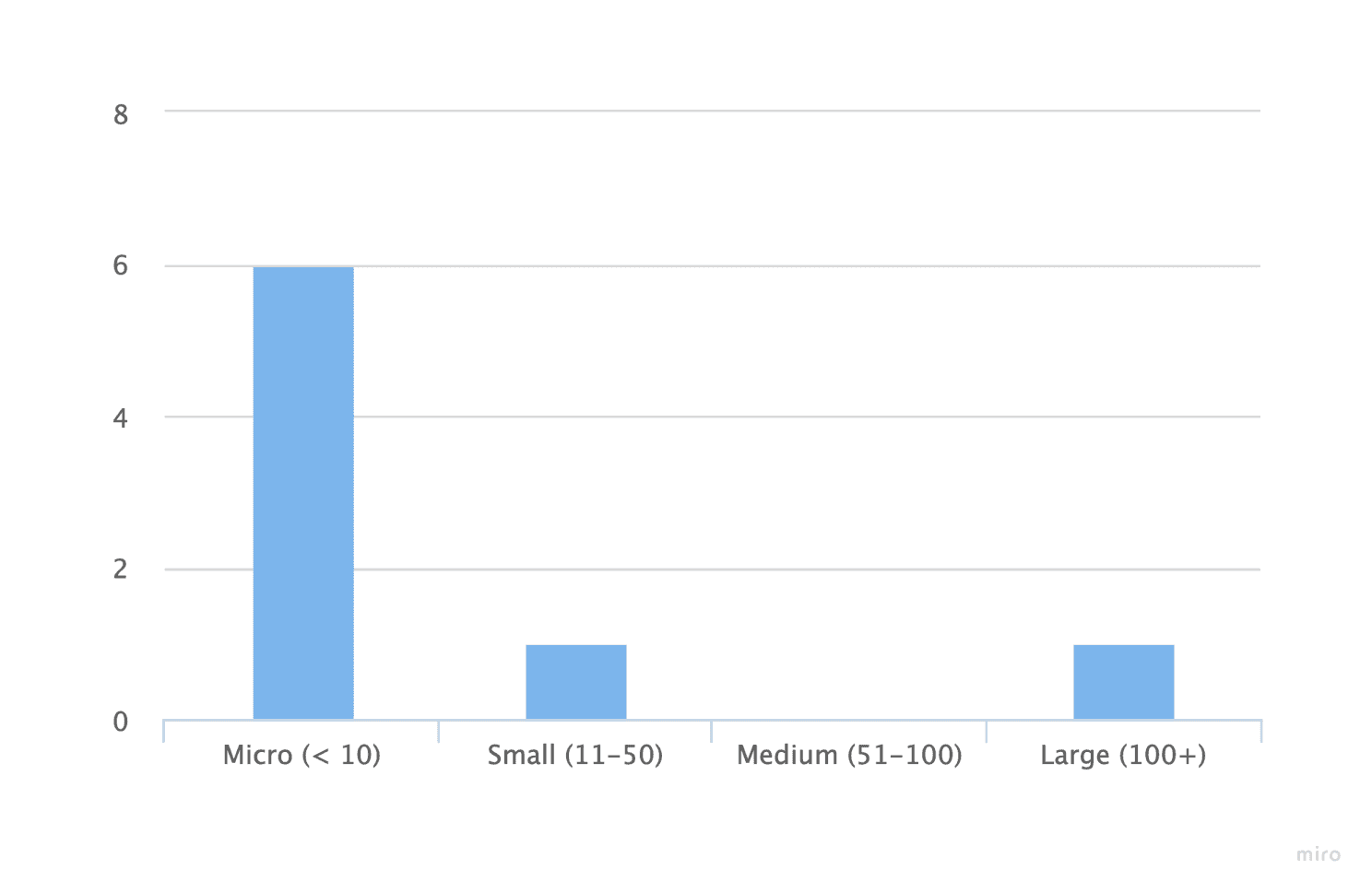

Business size

While the business size where community managers and builders worked could be skewed by our access to a wider audience of community builders in Australia, the majority of businesses we interviewed (75%) functioned as a collaboration of less than 10 employees - including the community managers themselves.

Business size breakdown:

Micro (<10) - 75%

Small (11-50) - 12.5%

Large (100+) - 12.5%

Medium (51-100) - 0%

NARU's CMB Research: Business size (2022-2024).

Predominantly because of the nature of startups and lack of funding, the smaller business size does often mean a community manager needs to take on more roles than 1 - with an alarming 53 different titles ranging from “Community Manager” to “Head of Marketing” being submitted at the ACM x The CC Community Manager Snapshot.

ACM x The CC Community Manager Snapshot: Job Title - 9 out of 53 titles (2023).

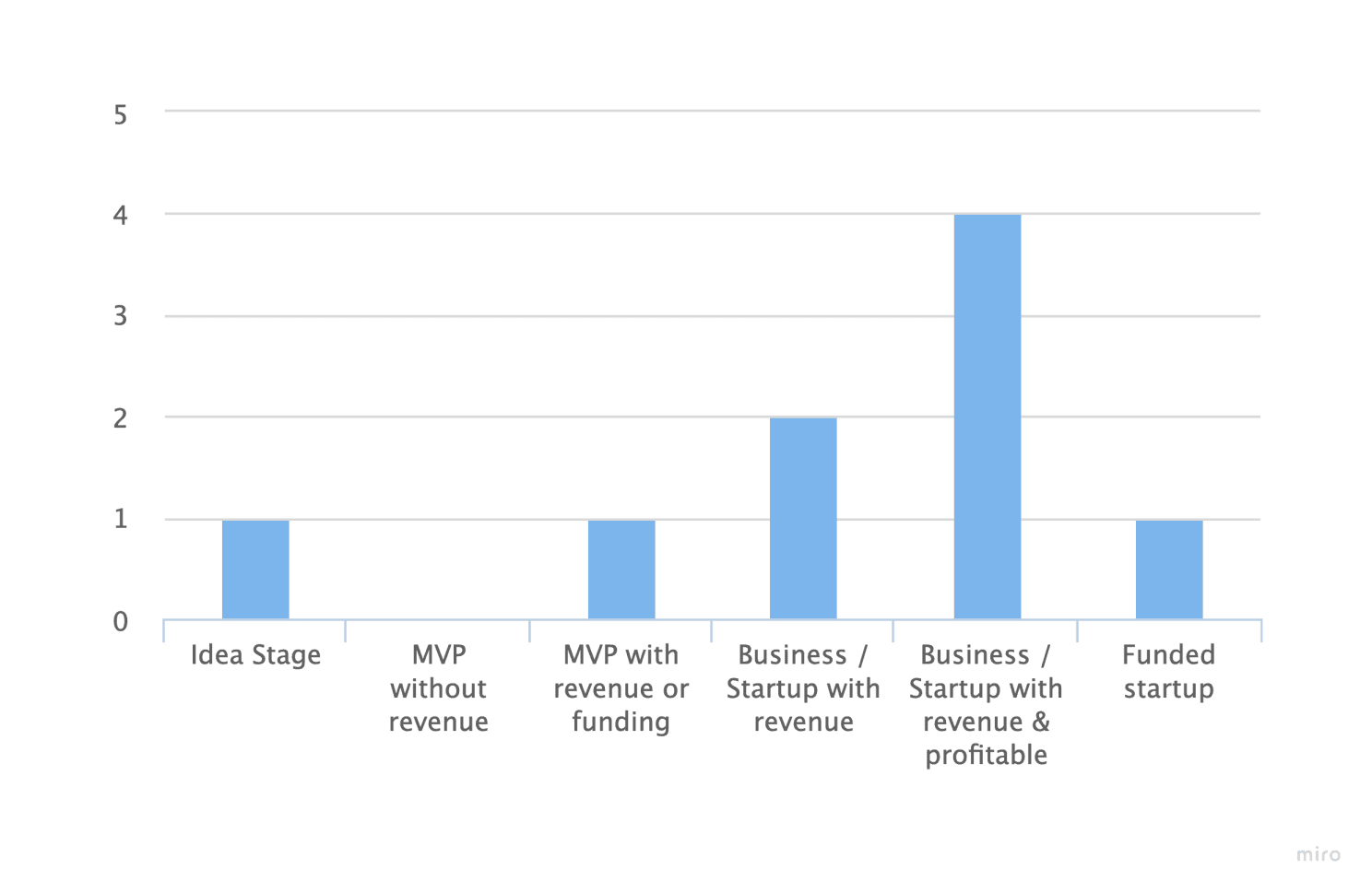

Business stage

From the ACM x The CC Community Manager Snapshot, we know that 48% of organisations budget around AUD 0-10k annually and 32% of community managers/builders make an AUD 71-100k salary between 2022-2023. Given that startups need to be at a revenue-generating and ideally profitable stage to invest in a community with allocated employees, we observe that 44.4% of businesses are this way, with 22.2% of startups not yet profitable but generating revenue nonetheless. A minority of startups are at the MVP or idea stage, with not much data for funded startups based on our interviews with smaller businesses.

Business stage breakdown:

Business/startup with revenue & profitability - 44.4%

Business/startup with revenue - 22.2%

MVP with revenue or funding - 11.1%

Idea stage - 11.1%

Funded startup - 11.1%

MVP without revenue - 0%

NARU's CMB Research: Business stage (2022-2024).

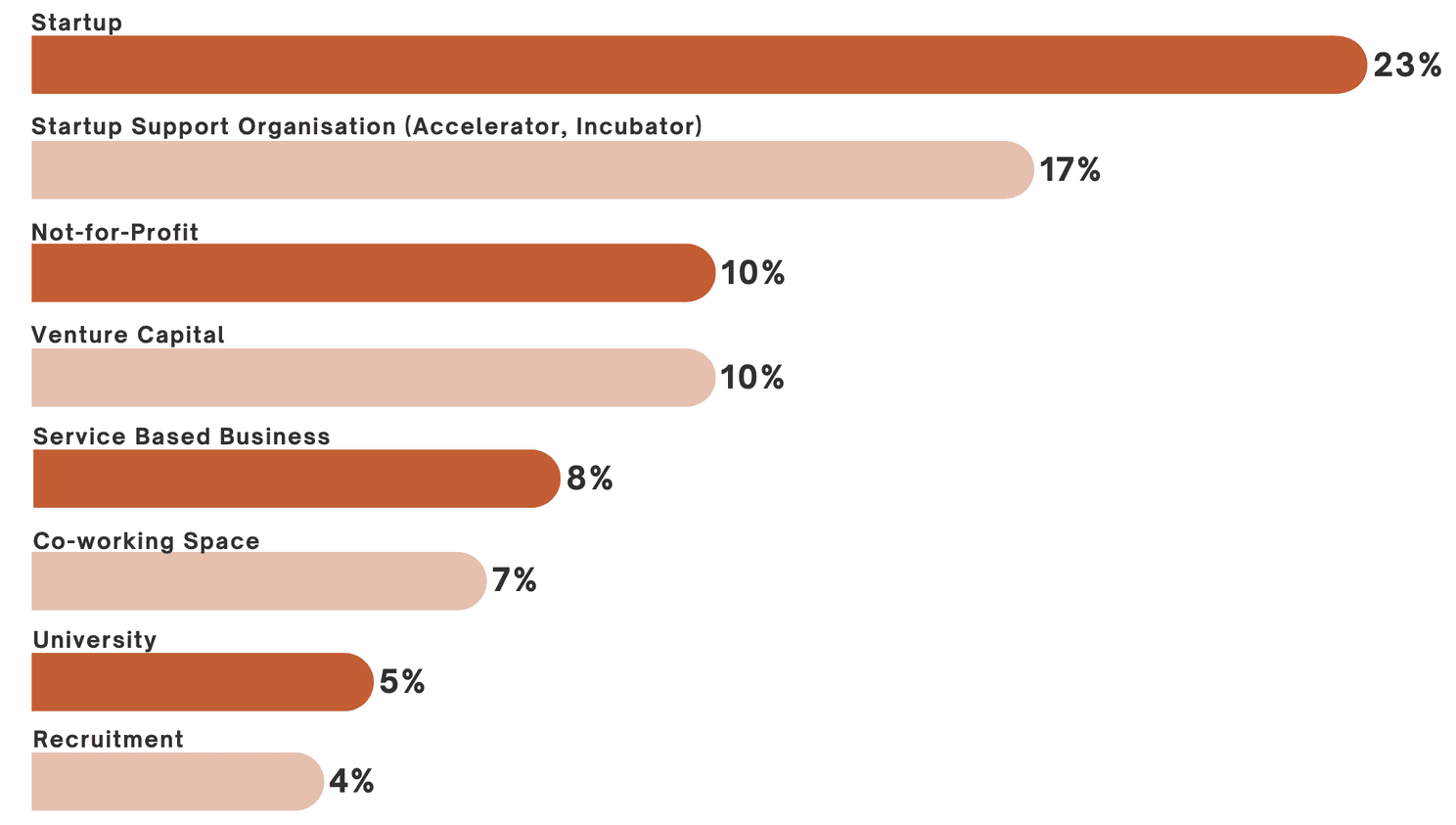

This is evident in the higher-than-average percentage of 23% of community builders who identify as working at startups as well as 17% at startup support organisations mentioned in the ACM x The CC Community Manager Snapshot.

ACM x The CC Community Manager Snapshot: Type of Organisation - Top 10 (2023).

Community Purpose

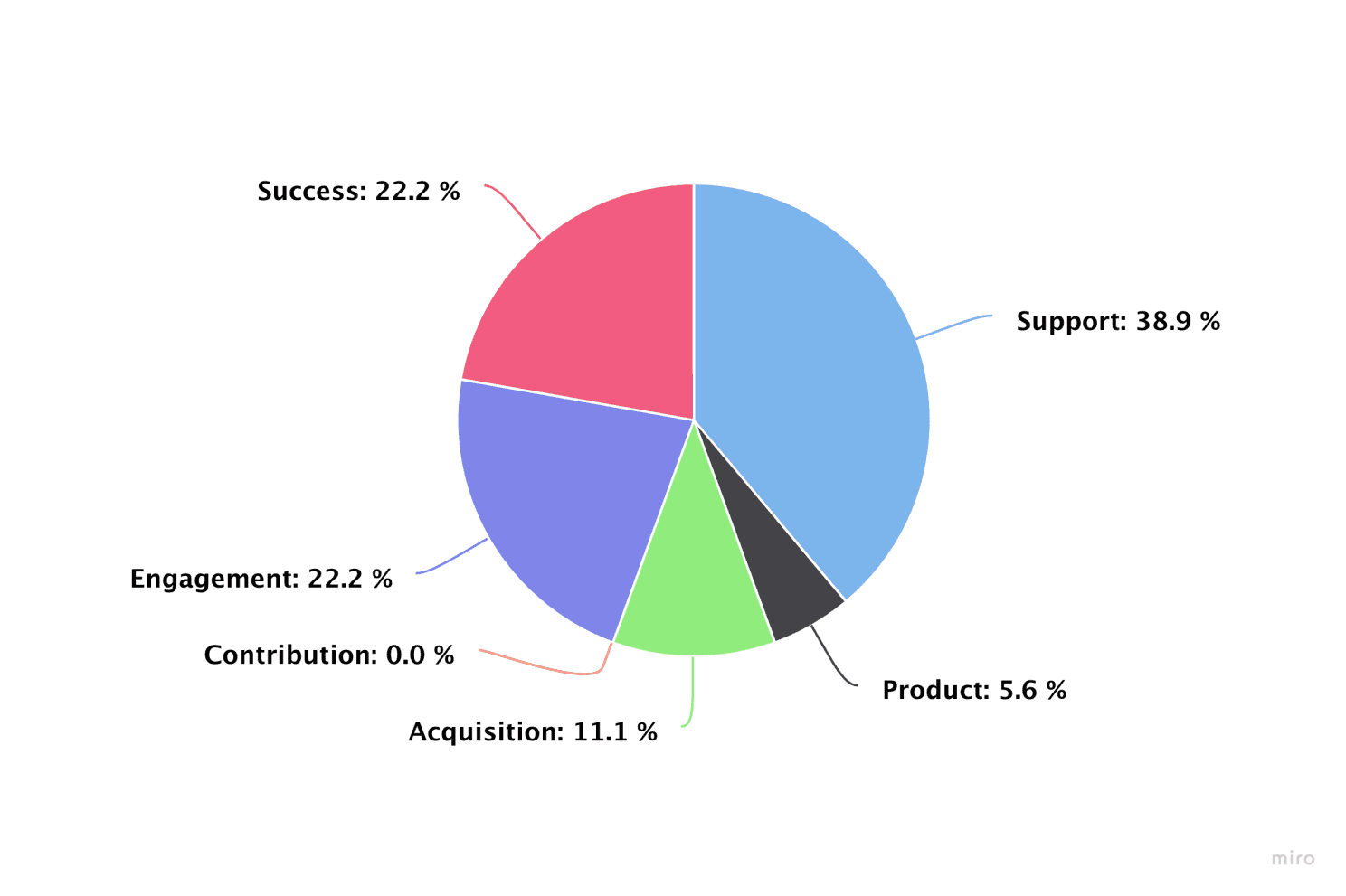

The answers to “What is the purpose of your community for your members/users?” often show why a community exists within an organisation. To simplify things, we are using CMX’s Spaces model to normalise our answers. From our research, we found that 38.9% of communities exist to support (e.g. using members to answer questions to improve customer satisfaction for other members and save costs), although significantly 22.2% exist both for customer success (e.g. connecting customers to drive product adoption) and engagement (e.g. improve loyalty and retention through a common interest).

Community purpose breakdown:

Support - 38.9%

Success - 22.2 %

Engagement - 22.2%

Acquisition - 11.1%

Product - 5.6%

Contribution - 0.0%

NARU's CMB Research: Community purpose (2022-2024).

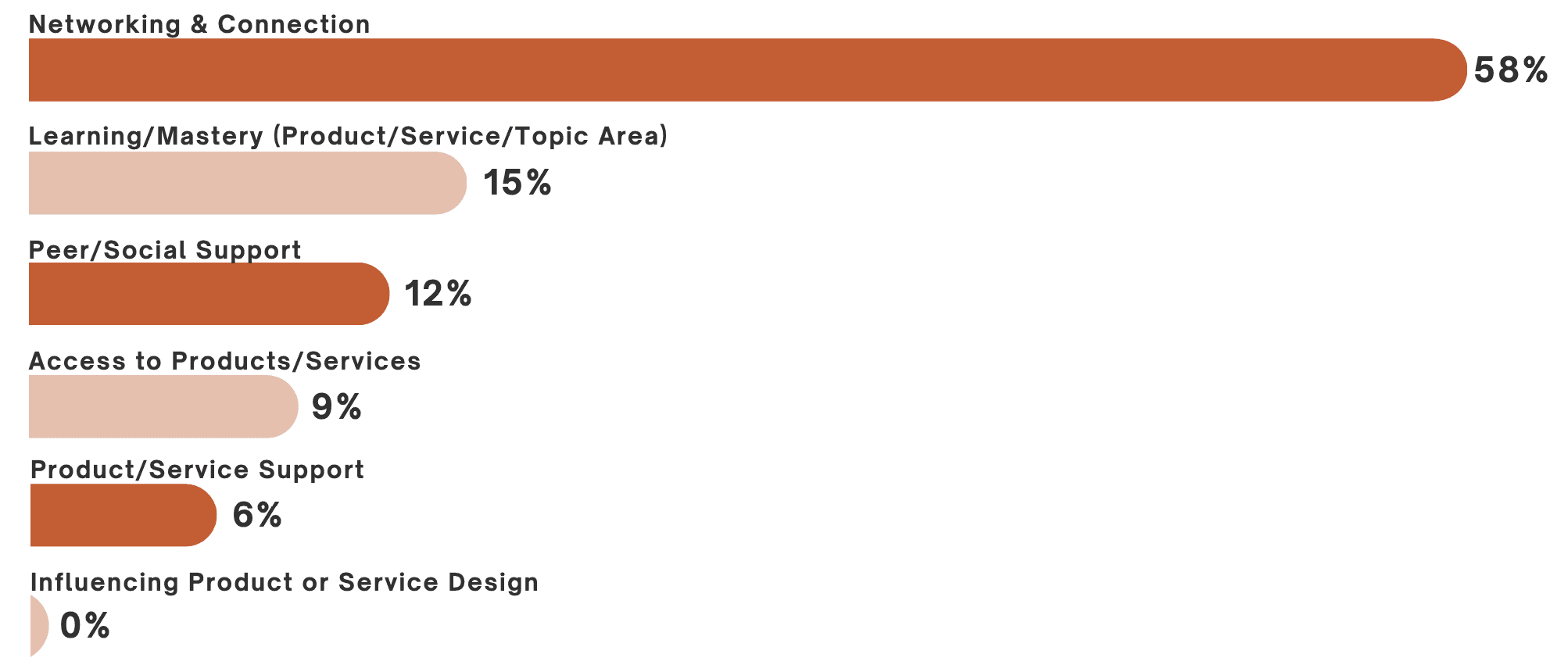

In contrast, the ACM x The CC Community Manager Snapshot found 58% of communities exist for networking & contribution (e.g. increase user-generated content, actions or resources to a collaborative platform), 15% for success (learning/mastery of a product/service/topic area), and only 12% for support (peer/social support). To justify the differences, we can deduce that these percentages may vary between the type and size of organisations and the industries they serve. For example, a car and parts business may invest in a community focused on driving customer loyalty and retention (aka. engagement), whereas a digital community for gardeners and plant growers may focus on making sure there is a thriving environment of user-generated content to help anyone coming in with problems (aka. contribution).

ACM x The CC Community Manager Snapshot: Purpose (2023).

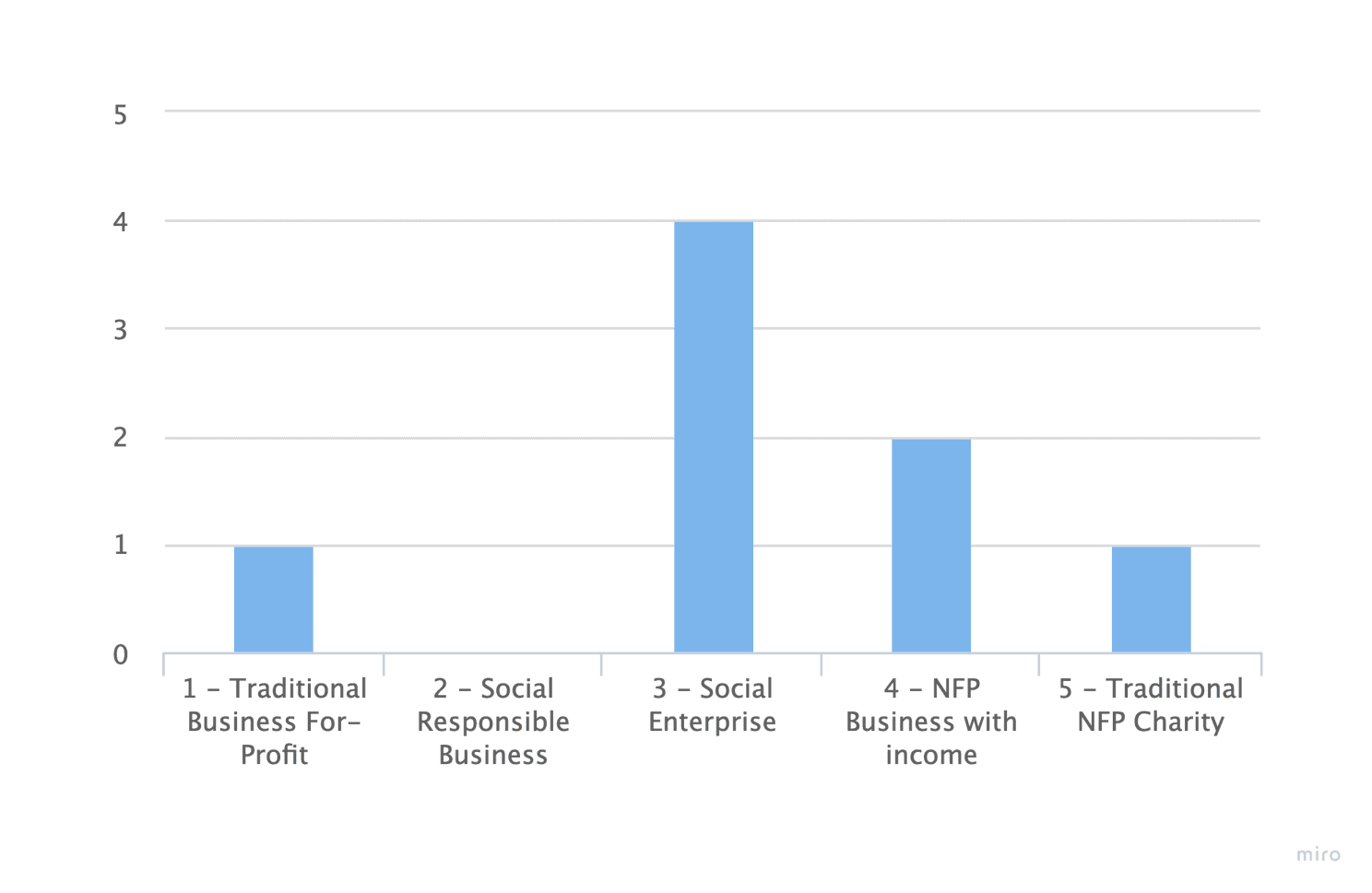

Social Impact Rating

As the world steers towards shedding more light on social movements and impact generation within future businesses, we started to question the current landscape of communities within the social impact ecosystem - whether they were traditional for-profit businesses, social enterprises, or not-for-profits/charities. We asked community managers/builders to identify their community's social impact and found that 50% of them identified as social enterprises, 25% of them as NFP businesses with income, and 12.5% of them both as traditional NFP charities and traditional for-profit businesses.

Social impact rating breakdown:

Social enterprise - 50%

NFP Business with income - 25%

Traditional NFP charity - 12.5%

Traditional Business For-profit - 12.5%

Socially responsible business - 0%

NARU's CMB Research: Social impact rating (2022-2024).

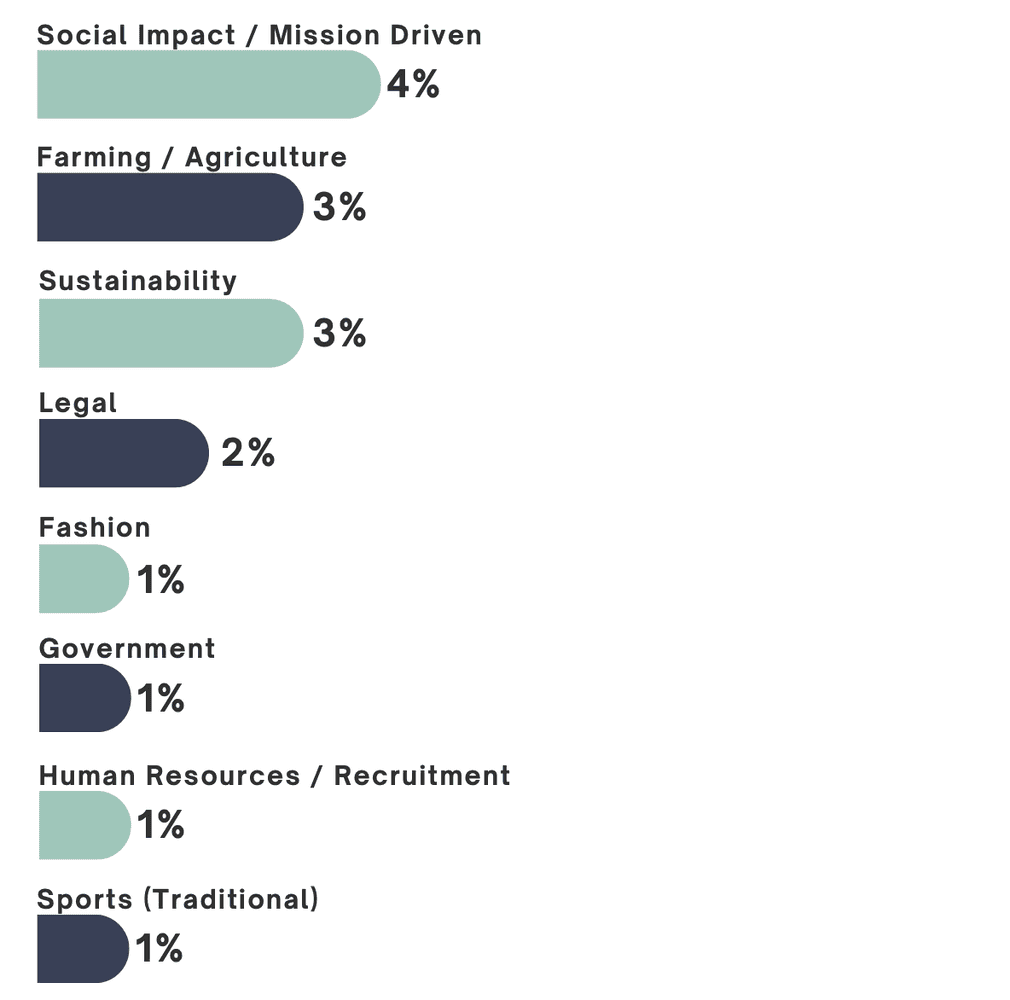

While we focused on the balance between organisations' social impact versus for-profit returns, the ACM x The CC Community Manager Snapshot highlights the explicit industries of community managers/builders - with only 4% identifying as a “Social impact/Mission driven” community. However, they also noted that while nationally, the top sectors building community are Social Impact/Mission Driven, Government and Media, with Health also strongly represented, these sectors rank lower in the startup space.

ACM x The CC Community Manager Snapshot: Industry Sector - Bottom 8 (2023).

Business Social Focus

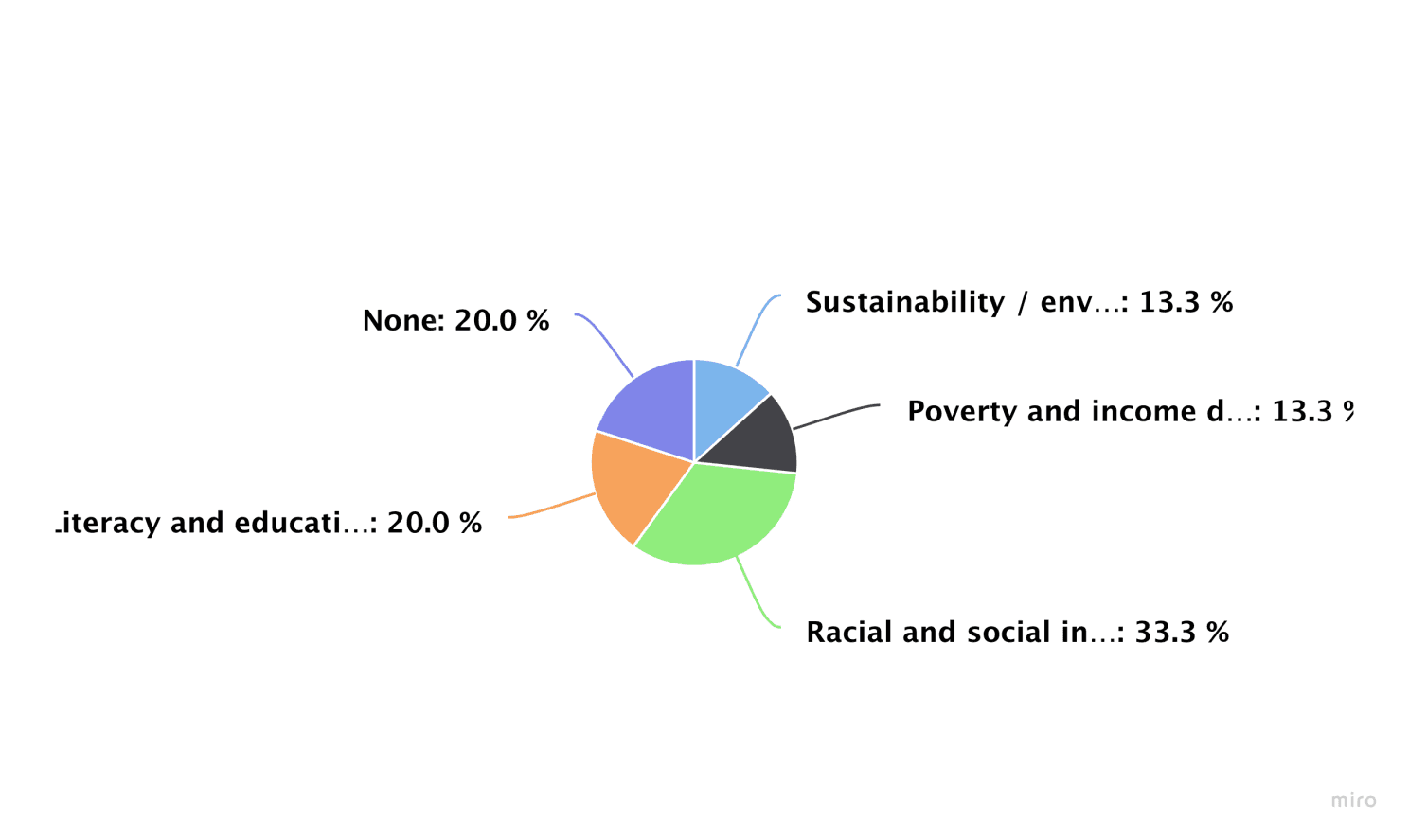

To understand the real impact communities are making through their for-impact lens, we broke down business social focus into 4 broad categories and “None” for organisations that were not focusing on social impact. Out of these 4, we found that 33.3% of communities focus on solving racial and social injustices, with an almost equally significant 20% for literacy and educational inequality. While 20% of our audience didn’t respond to having a social impact focus, we luckily also received responses for sustainability/environmental issues and poverty and income disparity.

Business social focus breakdown:

Racial and social injustices - 33.3%

Literacy and educational inequality - 20%

None - 20%

Sustainability / environmental issues - 13.3%

Poverty and income disparity - 13.3%

NARU's CMB Research: Business social focus (2022-2024).

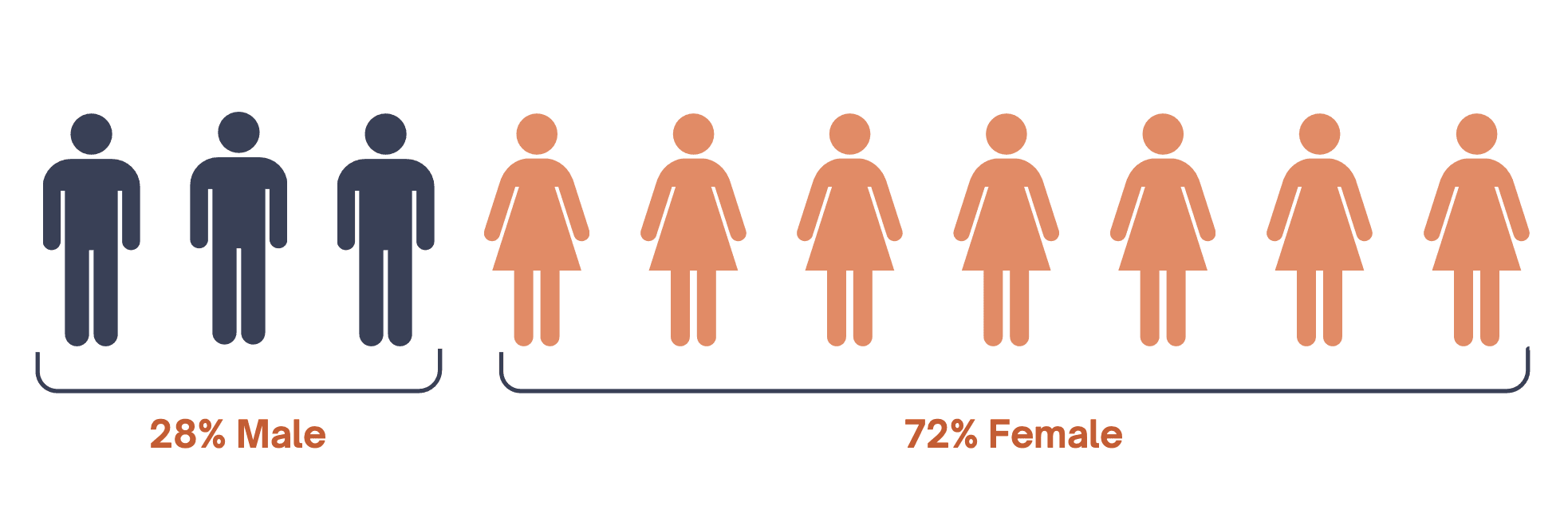

The abnormally high focus on social issues around racial and social injustices could be due to a high 72% of community managers/builders identifying as female, based on the ACM x The CC Community Manager Snapshot. As stated, “in every national State of Community Management Report since 2015, women have been the dominant gender engaged in Community Management in Australia and New Zealand (ANZ)”. This may affect the types of social focus we are seeing in communities today, as more women in community-building roles would mean action is likely to be taken towards issues involving their gender.

ACM x The CC Community Manager Snapshot: Gender (2023).

So, what’s next?

We discovered a few details about who makes up the term “Community managers and builders” in the Australian startup ecosystem in this newsletter. Next month, we will tackle the audience of our community builders as well as the platforms and tools they currently use to manage their audience. This is part of a 4 part series in the NARU Newsletter diving deep into the world of community management for startups and social impact communities in Australia.

Interested in contributing to the research as a community builder? Contact me or schedule a chat - we’re open arms and ears to hear from you!

Until next time,

Co-founder, Product @ NARU